READY TO PAY FOR GOVERNMENT WASTE? $11 Trillion in Bailouts. Billions in Bribes.

Posted by FactReal on April 21, 2009

THIS IS HOW $11 TRILLION DOLLARS LOOK LIKE….$11 TRILLION IN BAILOUTS SO FAR….

$11 TRILLION DOLLARS IN BAILOUTS!!!

THIS IS HOW GOVERNMENT IS WASTING YOUR MONEY WHILE YOU ARE LIVING YOUR LIFE

Bailout Summary (PDF), Government Waste (PDF)

What is Pork? Earmark? At the end it’s bribery: Lawmakers insert an expenditure into a bill to direct “chunks of the federal budget back to their home districts” to a specific project or recipient “to promote their own re-elections and reward special interests.”

| |

|

WASTE IN OMNIBUS BILL (Bill # HR1105)

9,000 EARMARKS were in this bill…to pay politicians’ special interest groups:

$6.6 Million for termite research

$5.8 Million for Ted Kennedy Institute for the Senate

$5.0 Million for sugarbeet/avian disease

$3.8 Million for tiger stadium

$2.7 Million for wood education (??)

$2.2 Million for grape genetics

$1.9 Million for a Pleasure Beach water taxi service project

$1.8 Million for PIG & MANURE ODOR

$1.7 Million for Honey bee

$1.2 Million for Citrus canker (which doesn’t affect the fruits)

$1.0 Million for Crickets

$819,000 for catfish genetics

$800,000 for oyster rehabilitation

$473,000 for leftist National Council of La Raza (The Race)

$469,000 for Fruit Fly

|

|

|

$380,600 for Carbon Neutral Green Campus

$300,000 for GO GIRL GO! (???)

$250,000 for Lobsters

$225,000 for EVERYBODY WINS! (???)

$209,000 for Blueberry improvements

$200,000 for TATTOO REMOVAL

$100,000 for READY WILLING & ABLE (??)

$21 Million for sod

$200 Million for the National Mall

$600 Million for new cars for the federal government

$650 Million for digital TV coupons

$ 50 Million in funding for the National Endowment of the Arts

$ 44 Million for repairs to U.S. Dept. of Agriculture headquarters

$ 75 Million for smoking cessation

|

FDR’S SPENDING WAS A RAW DEAL

|

|

2009 GOVERNMENT WASTE REPORT (from Citizens Against Government Spending)

The 2009 Pig Book found 10,160 projects at a cost of $19.6 billion

(an increase of 14% in cost)

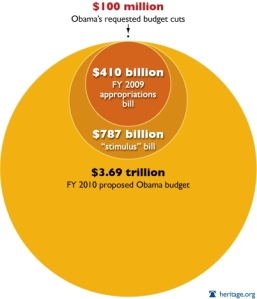

● The outrage of millions of taxpayers following the $700 billion bank bailout and the $787 billion stimulus bill did not stop Congress from passing and President Obama from signing a bloated $410 billion Omnibus Appropriations Act in March.

● With the subsequent approval of the President’s budget, the national debt will triple over the next 10 years.

OBAMA’S BUDGET PROPOSAL for fiscal year 2010

1. Increases spending to $3.55 TRILLION.

2. Adds deficits of $9.3 TRILLION over the next 10 years.

3. Raises taxes by as much as $3 TRILLION over the next ten years

Obama’s budget will waste taxpayer money:

1. Includes a $646 Billion Cap-and-Trade Energy Tax.

2. Makes a “Down Payment” on Socializing Healthcare.

3. Hands out Billions to leftist Agencies that Fund ACORN & other Community Organizers.

4. Increases Dept. of Housing and Urban Development (HUD) Funding

after It Helped Cause the Financial Crisis.

5. Claims that Government Knows Better than Taxpayers about Their Retirement.

6. Creates Yet Another Entitlement and Spends Billions on Pell Grants.

7. Spends $178 Billion on Interest on the Debt.

8. (As Part of Its $1 Trillion Tax Hike!) Raises Taxes by $1 Billion to Fund the Failed EPA Superfund Program.

9. Generates Even More Cheap Credit to Further Distort the Market.

10. Increases Funding for Space Exploration while the Country Suffers in Recession. |

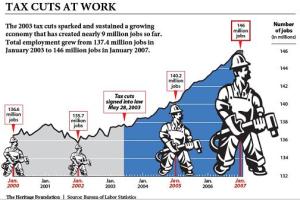

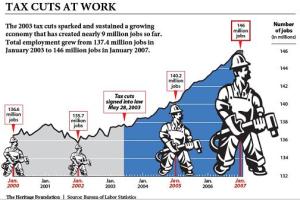

GOVERNMENT SPENDING DOES NOT STIMULATE

Most government spending has historically reduced productivity and long-term economic growth due to:

1. Taxes.

Most government spending is financed by taxes, and high tax rates reduce incentives to work, save, and invest —resulting in a less motivated workforce as well as less business investment in new capital and technology.

2. Incentives.

Social spending often reduces incentives for productivity by subsidizing leisure and unemployment.

3. Displacement.

Every dollar spent by politicians means one dollar less to be allocated based on market forces within the more productive private sector….politicians seize that money and earmark it for favored organizations with little regard for improvements to economic efficiency;

4. Inefficiencies.

Government provision of housing, education, and postal operations are often much less efficient than the private sector. Government also distorts existing health care and education markets by promoting third-party payers, resulting in over-consumption and insensitivity to prices and outcomes. Another example of inefficiency is when politicians earmark highway money for wasteful pork projects rather than expanding highway capacity where it is most needed.

|

|

NEGATIVE IMPACT OF OBAMA’S BUDGET

#1. The national debt will double over the next 5 years; and

it will triple over the next 10 years to $17.3 trillion.

#2. The national debt will soar over the next 10 years from 40% of GDP today

to a shocking 82.4%.

(Ronald Reagan left office with the national debt at 42% of GDP).

#3. Total federal borrowing will grow by $2.7 trillion this year alone,

an increase of 27% in 1 year!

#4. Increases federal spending by 34% over the previous year,

with a total of $4 trillion in federal spending, the highest ever.

#5. The federal budget deficit (not the national debt) would reach $1.845 trillion this year,

the highest ever.

(More than 7 times Reagan’s largest budget deficit of $221 billion, which caused so much consternation among Reagan’s critics.)

#6. This Obama budget deficit will total an astounding 13.1% of GDP,

more than one-eighth of the entire U.S. economy, for the federal budget deficit alone! |

|

|

(Under George Bush, the federal deficit for 2008 was 3.2% of GDP.

The deficit for fiscal year 2007, in the last budget adopted when Congress was controlled by Republican majorities, was $162 billion, or 1.2% of GDP.)

#7. Includes $1 trillion in tax increases on the upper 5% of income earners, mostly tax rate increases. But the top 5% of income earners (those making over $145,283) already pays 60% of all income taxes.

Bottom 50% of income earners pay about 3% of the national income taxes.

#8. Projects that revenues from the corporate income tax will more than double in 3 years, increasing by more than 124%.

#9. Another $645 billion tax increase comes from Obama’s anti-global warming cap and trade system, which is essentially an energy tax on the production and use of carbon energy, such as oil, natural gas, and coal.

#10. While the Obama administration claims to have cut $2 trillion from the budget over 10 years, fully $1.5 trillion of those “cuts” actually represents the troop drawdown in Iraq, which was already scheduled to occur under the Bush administration.

Of the remaining $500 billion in budget “savings,” fully $311 billion is categorized as “interest savings” but is actually an additional tax increase on upper income earners.

CAR BAILOUT – WHY AUTOMAKERS FAILED

1) Union Workers were paid to NOT work

2) Abusive labor union requirements

● Wages $75 per hour. While Toyota pays $48

● Health care adds $1,200 to the cost of each vehicle.

But only $215 for Toyota.

● Retire after 30 years of service, irrespective of age

● Seven weeks vacation

● Supporting More Retirees Than Active Workers

3) Idiotic government standards

● Making cars that Americans won’t buy

4) Excessive government interference

● Automakers have to pay for facilities they don’t use to support revenue bonds for municipalities

● State laws protect dealers from termination

BANKRUPTCY WILL ALLOW FOR:

● Labor contracts & pension plans to be renegotiated |

GUESS WHO PAYS THE MOST TAXES:

Poll & chart Poll & chart

Guess who really pays the taxes |

|

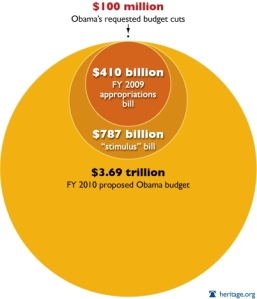

THIS IS OBAMA’S $100 MILLION BUDGET CUT versus HIS TRILLION DOLLARS IN SPENDING

WHAT IS MORE: $100 MILLION OR $3.7 TRILLION?

OBAMA HOPES YOU DON’T KNOW

Obama’s $100 million budget cuts (the small black dot) compared to his trillion dollars in spending: |

|

|

|

| RELATED

|

This entry was posted on April 21, 2009 at 2:28 pm and is filed under Economy, Government Waste.

Tagged: budget, Bush, Communism, Earmark, Economy, Government Waste, Obama, Obama budget, Omnibus, Socialism, Stimulus, tax cuts, Taxes. You can follow any responses to this entry through the RSS 2.0 feed.

You can leave a response, or trackback from your own site.

100 DAYS & 100 MONTHS: TORTURED BY LIBERALS (videos) « FactReal said

[…] READY TO PAY FOR GOVERNMENT WASTE? $11 Trillion in Bailouts. Billions in Bribes. […]

OBAMA’S BUDGET 101 « FactReal said

[…] READY TO PAY FOR GOVERNMENT WASTE? $11 Trillion in Bailouts. Billions in Bribes. […]

TEA PARTY DIRECTORIES ALL-IN-ONE…& Facts « FactReal said

[…] READY TO PAY FOR GOVERNMENT WASTE? $11 Trillion in Bailouts. Billions in Bribes. […]